The replacement of traditional payment procedures with new technology is altering the way businesses handle their finances. Businesses require merchant accounts and payment gateways in order to receive cashless payments from credit/debit cards and virtual currencies.

In this article, we will discuss how these two elements collaborate and what factors to consider when picking a Bitcoin merchant solution.

Key Takeaways

- A merchant account serves as a connection between a corporation and a customer’s finance institution.

- A payment gateway acts as the central cog in the payment processing system.

- Security, pricing, assistance line, etc., are crucial when choosing a BTC merchant solution.

Explaining a Merchant Account

A merchant account is a specific kind of financial account that enables companies to process and take payments online, including credit and debit card payments. The money that a consumer purchases from a physical shop or online is originally kept in the merchant account.

Processing time for the funds usually ranges from one business day to seven business days. However, this might vary per agreement with the merchant services provider. After everything is taken care of, the money is sent to the company’s bank account.

Establishing an e-commerce account is paramount for enterprises to manage and process credit and debit card transactions. It plays the role of a go-between for the company and the customer’s banking provider. After a short period of time, the sales revenue is transferred to the business’s bank account minus any applicable fees.

Cryptocurrency e-commerce has gained popularity in spite of its high-risk nature and complex regulatory landscape, offering numerous merchant account options. Transactions are irreversible once the customer sends payment, and processing fees are nonexistent, making crypto merchant account services a rapidly growing segment of cashless payments.

Сrypto merchants face risks and regulations in unregulated accounts, necessitating trusted solutions from high-risk e-commerce providers. Best Bitcoin merchant accounts stimulate companies to accept payments in various virtual coins, eliminating currency conversions and cross-border fees.

Verified identification and business background are demanded for merchant accounts for crypto, as well as connection to a crypto gateway. Identity verification is a requirement for bank accounts as well. Once the customer pays, they can’t undo the transaction.

Also, no charges apply to these payment processing methods, causing an increase in the use of crypto business bank account services for online transactions.

Explaining a Payment Gateway

The gateway simplifies funds transfers from a customer’s bank account to the business’s bank account. They assist businesses in identifying and preventing fraud, as well as facilitating cross-border payments. In order for them to function properly, they must be linked to a payment service.

The gateway ensures the transaction is authorised or denied, facilitating the smooth flow of transactions. It verifies customer card details with the respondent bank, sends a transaction notification, and, if approved, funds are transferred.

Payment gateways are essential in the digital economy for customer convenience, ensuring faster transactions for vendors, reduced fraud risk, robust security measures, and regulatory compliance. They facilitate seamless transactions across borders and currencies and are also crucial for the blockchain sector.

Crypto payment systems allow enterprises to adopt crypto in exchange for products or services, acting as a bridge between the blockchain network, retailer, and customer. Buyers select products, choose digital token payment options, and send coins to a specific address by scanning a QR code generated by the gateway.

The payment gateway verifies the transaction’s validity by checking the blockchain network. The time it takes can vary depending on the specific digital currency and the congestion of the network. Certain gateways are capable of translating virtual money into traditional currency automatically, which can help stabilise the market, albeit at an additional cost.

Using a crypto-paying gateway allows businesses to receive payments from clients worldwide without needing conventional payment infrastructure or finance companies, saving costs and boosting efficiency for digital companies.

How Merchant Accounts and Payment Gateway Collaborate

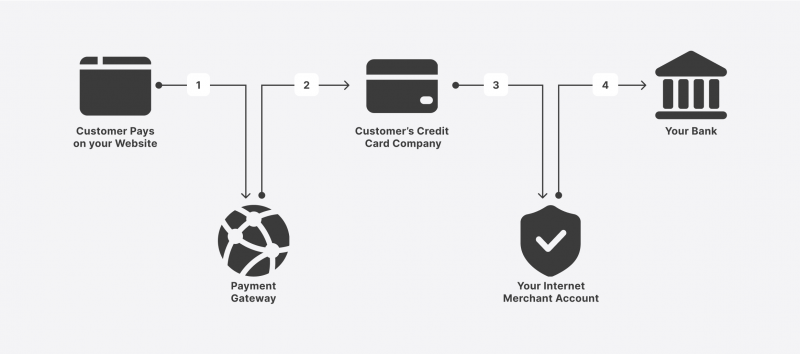

The teamwork of the mentioned accounts and paying gateways is crucial for seamless payment handling and allows us to understand how to pay using BTC.

The payment process begins with a customer initiating a payment, which is then forwarded to a payment processing engine. The processor verifies the transaction by contacting the customer’s bank for authentication.

Once validated, payments are for a short while held in the merchant’s account before being sent to the business’s primary bank account.

The payment engine and business bank account provider meticulously review transactions to ensure precision and avert fraud. After thorough affirmation, funds transition smoothly from the operating account to the business’s banking account.

The payment system gathers the customer’s card details, including the card number, expiration date, and security code, when they make a purchase online or in-store. The information is held confidential and then forwarded to the customer’s bank for validation.

The bank ensures that the card is legitimate, adequately funded, and authorised for use. Once the bank gives its approval, the transaction is finalised. The payment info is sent by the gateway to the business’s bank account for further processing.

The merchant account verifies the transaction information, handles it, and transfers funds from the customer’s bank to the business’s bank. The gateway affirms the transaction, allowing the client to complete their purchase.

Merchant Account vs. Payment Gateway

These two elements do different things when it comes to handling payments.

The presence of crypto payment processors is essential in facilitating the secure and safe movement of money between banks. Secure transmission and exchange of important data are enabled through the secure transmission of payment information by the payment gateway.

Once a purchase is completed, the card issuer transfers the funds to the store’s bank account. They retain it for a short period of time before transferring it to the business’s main bank account.

A digital payment account makes it easy to send money and store information, while a gateway is used to handle and move money during transactions. Both are required for processing payments from both credit/debit cards and crypto.

Merchanting accounts are used by businesses to push transactions into their banking account, while end consumers use gateways to pay for services or products.

How to Start Accepting BTC Payment

BTC and other digital currencies are popular means for business owners due to their cost-effectiveness, ease of transacting, and the absence of chargeback fees. Additionally, BTC operates similarly to cash, eliminating the risk of chargebacks or disputes.

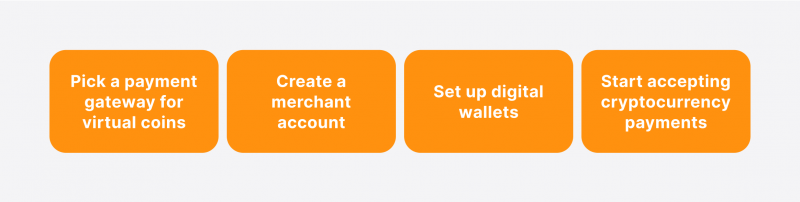

To initiate accepting crypto payments as a business, you should complete the following steps:

1. Pick a payment gateway for virtual coins

Pick the finest crypto payment gateway that suits you based on security, supported cryptos, transaction fees, and consumer support, and incorporate the gateway into your website.

2. Create a merchant account

After picking a gateway, create an account with them. Consider pertinent account features and functionalities while creating a customer account.

3. Set up digital wallets

To take remunerations and convert them into your preferred fiat currency, it’s essential to set up a multi-cryptocurrency wallet. Multi-currency wallets are the most popular choice, as they provide near-unlimited freedom in choosing different types of virtual assets.

4. Start accepting crypto

Once integration and wallet setup are complete, you can adopt BTC payments on your website. Ensure that you inform them about this payment option on your website or application.

How to Determine The Best BTC Payment Solution

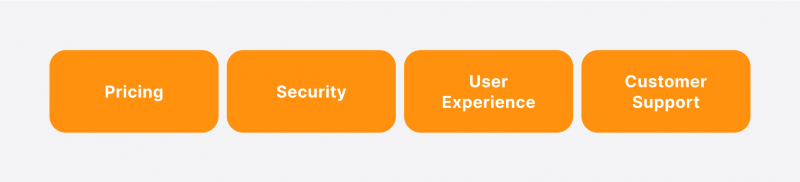

Finding the right payment solution for your corporation can be challenging. There are many factors to consider, including the following:

Pricing

Dealing fees greatly impact a business’s bottom line, especially for regular BTC transfers. Pick a solution with competitive fees and reliable services to equalise cost and quality.

Security

A respected BTC payment solution should offer powerful security measures, including industry-standard encryption protocols, 2FA, and cold storage for funds while respecting client privacy by adhering to strict policies.

Ease of Use

Pick an option that offers optimised hosted pages, integrations with popular wallets, and easy crypto option selection.

Customer Support

Select crypto payment providers offering reliable and constant support and promptly addressing clients’ troubles and issues.

Supported Currencies

The blockchain payment system should support popular cryptos like BTC and ETH, as well as tokens aligned with your business niche, allowing a broader consumer base.

Final Takeaways

Both merchants’ accounts and paying gateways are imperative for corporations to handle web-based and in-store payment operations. Both are crucial for preventing fraud and staying competitive. Both options are foremost for a successful Bitcoin merchant solution.